HSBC as the World’s Oldest Drug Cartel

Under Queen Victoria (reign 1837-1901), British core values has been implicated in one scandal after another, and their current leadership claim to be wanting to restore its imperial reputation. In the East, its dark past is an altogether darker reputation reflecting HSBC’s original role as a source of funding for the giant trade of opium into the Chinese markets in the nineteeth century.

When HSBC executives were caught late last year financing the Mexican and other drug cartels, they were just returning to the company’s historic roots!

Unpublished Articles • Timeless

HSBC and the Opium Wars of 19th Century China

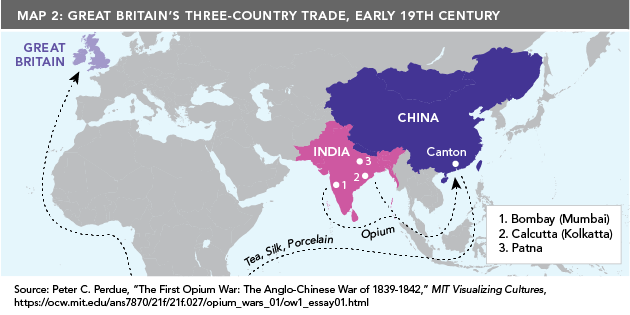

HSBC (also known as the Hong Kong Shanghai Banking Corporation with assets of US$3.038 trillion) is an investment and commercial bank founded in 1865 in Hong Kong. The island of Hong Kong is a small mountainous island located close to Southern China that was placed under British rule as reparations following The Opium Wars of 1839 and 1856, that ultimately ended in 1860.

The bank’s origins lie in this South East Asia region, where the bank branches first opened under the name “Hongkong and Shanghai Banking Corporation Limited.” The bank was first created in Hong Kong in the Spring of 1865 and was then followed with an office in Shanghai, China just one month later.

HSBC was formed to help develop trade between British merchants and the Chinese mainland, using Hong Kong Island as a safe haven for business, which had then been under British Rule for five years.

HSBC: the First Bank in Hong Kong

HSBC’s Hong Kong connection explains why the bank is still primarily a British owned and British themed company. The Bank was formed in Hong Kong just five years after the British devastated the Chinese in the armed conflict of the 2nd Opium War in 1860, in which the British took the island of Hong Kong from the Chinese as war reparations.

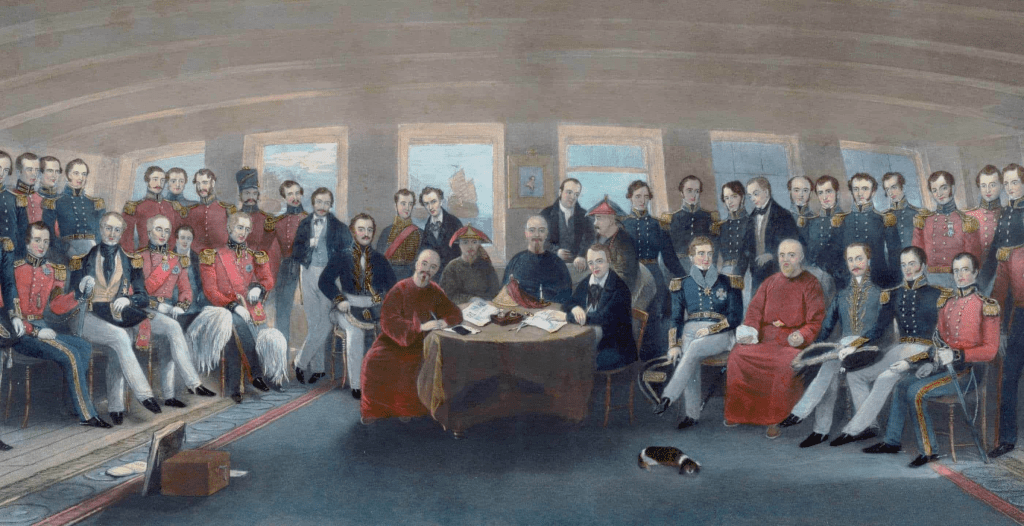

Even though the British took few human losses in the Opium War engagements, thousands of innocent Chinese civilians were killed through the relentless shelling by the British Navy and ground attack by their Marines. The surrender by the Qing Dynasty to the British forced China to give up Hong Kong island and to allow all foreign traders full rights to travel and do business throughout China.

The notoriously one-sided deal also granted freedom of religion in China and the legalization of Opium. The poppy drug was the primary imported commodity, which was exchanged for Chinese goods that were brought back to the West. HSBC leveraged those business for huge profits and garnered a majority foothold in the region.

HSBC was the first locally owned and locally managed bank in Hong Kong, but was initially set up and protected by the British Government. Most of its commodity trade can be traced back to importing raw Opium directly from India into the eighty Chinese trade ports, with a common stop-off in the British port of Hong Kong.

Hong Kong Island had a rare deep water harbor, ideal for large vessels which was one of the reasons that the British took the island in the first place, as it allowed their giant warships safe haven from attack. Macau, a peninsula Island very close to HK and similar in many respects to Hong Kong, was taken by the Portuguese as reparations on another 100 year lease at the same time.

This Chinese peninsula, however, never grew to anything larger than a fishing village, due to its shallow bay and poor location on the trade route. Macao more recently took off as the world’s premier gambling center and is now only a 30 minute ferry ride from HK. HSBC now has thirty offices in Macau.

The Opium Wars, the Formation of HSBC and Boxer Rebellion

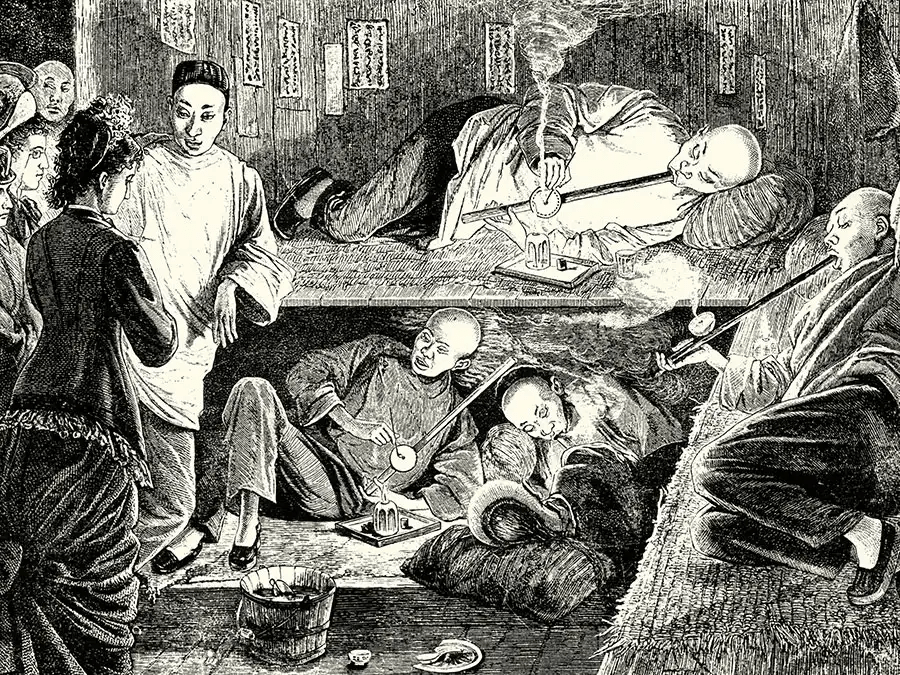

Prior to the British occupation in Hong Kong, Opium had been banned for over half a century in China. When HSBC was first created in 1865, the bank helped European merchants distribute opium across China, using Hong Kong as the trading hub.

Despite their protestations, the worst fears of the Chinese government had been realized from those that led to the prior Opium Wars in 1839 and 1856, in which China desperately attempted to stop the British, French and Portuguese from importing the Class A drug to their clean shores. This was a drug that European countries had already banned, but saw China as a money making opportunity.

The Chinese push back on the import of opium angered the European partners and led to the two wars, which stretched over a 20 year period. Following the wars, European merchants, with the help of HSBC, were able to create distribution infrastructure and networks across China and the Chinese drug trade in opium became their number one traded commodity.

Any push-back from the Chinese government was met with swift action from the British and It wasn’t until 1900, at the Boxer Rebellion in Peking, that the Chinese tried again to rid their shores of the European invaders and their imported opium.

The Boxer Rebellion, was really the Third Opium War, but as it was initially fought with civilians, opposed to the Chinese Imperial Army, it goes down in history as an uprising. During this turbulent time in Chinese history, members of the Boxer organization murdered all the Europeans they could find in China and thus yearned to return to the traditional ways.

The HSBC banking branches in China were stormed by the Boxers and the staff were executed. The remaining Europeans retreated to the British Legations building in Peking and after a 55 day siege, that killed thousands of combatants and civilians, the European armed forces were able to rescue them. These events gave Europeans the final excuse for a full blown invasion of China and heavy reparations were ultimately paid by China over the next 39 years to a host of European nations.

The Chinese emperor fled the Forbidden City, only to return two years later and be instructed by the British to destroy the Chinese way of life in favor of a European approach, with executions, modernization and religious and social change that finally led to the destruction of the Chinese dynasty and the subsequent rise of Communism as its backlash.

HSBC was perfectly placed, as the only European bank, to take full advantage of the changes that were created through the bloody unrest in China. It is hardly surprising that given the gory history of the bank, that China is not a big fan of the organization. HSBC may have a Chinese sounding name, but there is nothing Chinese about it except a source of deep national shame. HSBC has never apologized to the Chinese people for its part in the atrocities and it would prefer its bloody past be forgotten.

HSBC Head Office Moves from Hong Kong to London in 1993

In 1993 the HSBC head office was moved from Hong Kong to London. This move was related to the fact that the Chinese Government were forcing the British to live up to the terms of the 100 year lease and return the island back to their ownership in 1999.

Back in 1899, the Qing Dynasty was originally force to sign the agreement under duress and now the Chinese had no intention of allowing an extension on the lease that was written in Chinese tears. If HSBC had stayed headquartered in HK this would have meant that bank would have now fallen under Chinese ownership. It was anticipated that if HSBC had stayed, the Chinese would have destroyed the company, much like their subsequent destruction of all the other remnants of British colonialism and rule in HK.

China has been very busy since 1999 erasing every artifact from the last 100 years of British rule and you would never know now they were ever there. Only park and street names remain where there were huge British housing divisions, buildings and ports.

Tensions over the history of the island still run high with the Chinese and they have not forgotten what the British did to them over a century ago. HK has often been the subject of Chinese national shame. Many argue that HSBC garnered its initial success through getting Chinese citizens addicted to drugs. Much like Deutsche Bank was a mainstay bank of the Nazi’s during WW2. It seems that many large international investment banks often have blood on their hands for making profits on the misery of innocent people.

Tax Justice Network • February 27, 2015

Winston Churchill famously wrote that history is written by the victors, which might explain why so little attention is paid in Britain to the infamous Opium Wars of the nineteenth century, which saw the Brits using their superior naval power to open up ‘free trade’ with China. Opium — sourced initially from India — was by far and away the largest product traded by British merchants in return for Chinese silks, tea and porcelain.

Facing understandable resistance from Chinese Emperor Tao Kuang and Lin Tse-hsu, his governor-general of the Liang Hu vice-regency, who was determined to stifle opium trade in his province, the British merchants resorted to violence to destroy the Chinese ability to impose their own laws and social protections. As Rolling Stone’s Matt Taibbi put it:

If you’re rusty in your history of Britain’s various wars of Imperial Rape, the Second Opium War was the one where Britain and other European powers basically slaughtered lots of Chinese people until they agreed to legalize the dope trade (much like they had done in the First Opium War, which ended in 1842).

Opium trading was crucial to the British economy at that time. Some have interpreted the Opium Wars as being primarily rooted in an ideological struggle between British economic liberals and Chinese protectionists, but Julie Lovell’s interpretation of the driving forces is probably closer to the truth:

In light of the British addiction to Chinese exports . . . opium was the only commodity that saved the British balance of payments with Asia from ruinous deficit. Marchant argues that mid-century British merchants in China believed that a ‘just war’ should be fought to defend progress. In reality the British leaders of the opium trade through the 1830s and 1840s were far more interested in protecting their drug sales in order to fund lucrative retirement packages (one of their number, James Matheson, used such profits to buy a seat in Parliament and the Outer Hebridean island of Lewis).

Wolf Street • February 11, 2015

Turning A Blind Eye to Banker Crimes

France, Belgium, Spain, the US, and Argentina have already launched legal proceedings against HSBC and its high net worth clients. But not so the UK, whose tax authority has used the data to bring only one measly prosecution in the last five years.

Worse still, according to The Guardian, the UK authorities were allegedly already in possession of detailed evidence about wrongdoing at HSBC’s Swiss bank when the country’s premier David Cameron appointed Stephen Green, the executive chairman of HSBC from 2006-10, as the country’s Minister of Trade.

Upon Green’s appointment, the government’s business secretary, Vince Cable, had the following to say:

In Stephen we will be appointing a minister with a long career as a leading international banker. [He is] one of the few to emerge with credit from the recent financial crisis, and somebody who has set out a powerful philosophy for ethical business.

For the moment Lord Green (yes, he was also given a knighthood) refuses to comment on the case, for “reasons of principle” – one assumes an oblique reference to legal as opposed to moral principle.

As for the institution he once headed, it is unlikely to face much in the way of legal fallout, at least at home, thanks to recent changes in UK tax law aimed at protecting “professional advisers, Swiss paying agents and their employees” from criminal investigation by Her Majesty’s Revenue and Customs. The fact that one of the men responsible for introducing the new law – a senior tax inspector by the name of Dave Harnett – is now a lavishly paid consultant for HSBC is mere happenstance.

No Pain, No Consequences

Given the UK economy’s disproportionate dependence on the City of London, it’s hardly surprising that’s its government – whether under the control of Labour or the Conservative party – is completely in thrall to the country’s big 4 banks (HSBC, Barclays, Lloyds and RBS). But it’s not just the UK authorities that are effectively hostage to big banks like HSBC.

Just about every nation on the planet is, including the most powerful. In the U.S. the big banks, with a little help from government, have created a legal system that authorizes their plunderous way of life, as Attorney General Eric Holder openly admitted in 2013:

I am concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them when we are hit with indications that if you do prosecute, if you do bring a criminal charge, it will have a negative impact on the national economy, perhaps even the world economy.

The message is unequivocal: there will be no prosecutions of systemically important banks – or for that matter the bankers who run them. Like Al Capone’s merry band of trigger-happy bootleggers before their fateful brush with the legendary Chicago lawman Elliot Ness, today’s too-big-to-fail banks can flout pretty much every law of every land without the slightest fear of sanction – except, that is, for the daintiest of financial slaps on the wrist. Such fines, whether counted in the millions or billions, have become mere costs of doing business.

When it comes to financial rap sheets, no bank – perhaps not even Goldman Sachs – can hold a candle to HSBC. In the last six years alone it has been accused of and/or has admitted to:

- Rigging just about every financial market imaginable (from LIBOR and foreign exchange markets to gold, silver and oil).

- “Misselling” wholly inappropriate products such as interest rate swaps to “unsophisticated” customers.

- Laundering money for Mexican drug cartels. This included transporting billions of dollars in armored vehicles, clearing suspicious checks, and helping traffickers buy planes through Cayman Island.

- Helping rogue states such as Iran and North Korea avoid international sanctions.

- Working closely with Saudi Arabian banks linked to terrorist organizations.

This is just a sample of the crimes and misdemeanors that HSBC is known to have committed in the last six years; yet not a single senior executive has faced a single night in jail for a single one of them. So it is that a bank born 150 years ago from the proceeds of a deadly trade – a trade it still dabbles in to this day – continues to operate with the utmost impunity and government-sanctioned immunity from the law.

What’s worse, should it – or any bank of a similar size – ever face serious financial difficulties as a result of their criminally reckless activity (and they almost certainly will), they are guaranteed to be bailed out with taxpayer funds and/or bailed in with depositors’ savings.

Woe unto you that desire the day of the LORD! To what end is it for you? The day of the LORD is darkness, and not light:

as if a man fled from a lion, and a bear met him; or went into the house and leaned his hand on the wall, and a serpent bit him.

Shall not the day of the LORD be darkness, and not light? Even very dark, and no brightness in it? Amos 5:16-20And I will set My jealousy against thee, and they shall deal furiously with thee. They shall take away thy nose and thine ears, and thy remnant shall fall by the sword. They shall take thy sons and thy daughters, and thy residue shall be devoured by the fire. Ezekiel 23:25