Beijing Vows Retaliation If Trump . . .

As President Joe Biden nears the end of his term, President-elect Donald Trump has pledged tougher trade policies against China. Earlier this week, Trump announced plans for a 10% tariff on all Chinese imports, reigniting fears of another trade war; and then another 100% to any country avoiding the US dollar as their reserve currency or for trade.

Yahoo News • December 2, 2024 ~ Yahoo News

President-elect Donald Trump threatened to slap 100 percent tariffs on a group of developing countries that includes Vladimir Putin’s Russia and Xi Jinping’s China unless they commit to the US dollar as their reserve currency.

“The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER,” he wrote Saturday on Truth Social, referring to the bloc that also includes Brazil, India, China, South Africa, Iran, Egypt, Ethiopia and the United Arab Emirates.

“We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty US Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful US Economy.”

The BRICS have, since last year, toyed with the concept of “de-dollarization,” which would see them lean on alternatives to the US dollar for global trade, including conducting more trade in their local currencies.

Putin, in particular, has advocated for the idea in the wake of massive sanctions placed on Russia for ordering a full-scale invasion of Ukraine—a violation of international law, according to experts and the head of the UN.

The BRICS control 42 percent of global central bank foreign exchange reserves, according to ING.

Barrons: A Trade War May Not Go Trump’s Way. China Has His Number

And so how would Beijing response?

China could tighten further export restrictions on gallium and germanium. Gallium is used in compound semiconductors, which are often used to improve transmission speed and efficiency in radars. Germanium is used in night-vision goggles and the solar cells used to power many satellites.

Not only is antimony crucial for strengthening alloys and producing everything from bullets, nuclear weapons, explosive missiles, solar panels to batteries, but its demand is skyrocketing as nations scramble to secure supply chains for critical resources.

According to figures for 2023, 63 per cent of the 22,000 tons of antimony imported by the US came from China. Antimony prices have tripled since earlier this year from $12,000 per ton to over $38,000.

Last December, China imposed export controls on graphite, a key raw material for making electric vehicle batteries. Sweden’s Northvolt, a battery startup and perhaps the only hope of Europe for battery technology, had filed for bankruptcy.

Skydio, a leading US-based drone manufacturer, has revealed significant disruptions to its battery supply chain, exposing the vulnerabilities of American industries reliant on China’s suppliers. Now, Skydio is in serious crisis.

In September this year, Beijing started restricting the export of antimony, which is used in military equipment such as infrared missiles, nuclear weapons and night-vision goggles, and as a hardening agent for bullets and tanks. Such supply could be tightened further; risking the American NGAD multi-trillion dollar project on the blink.

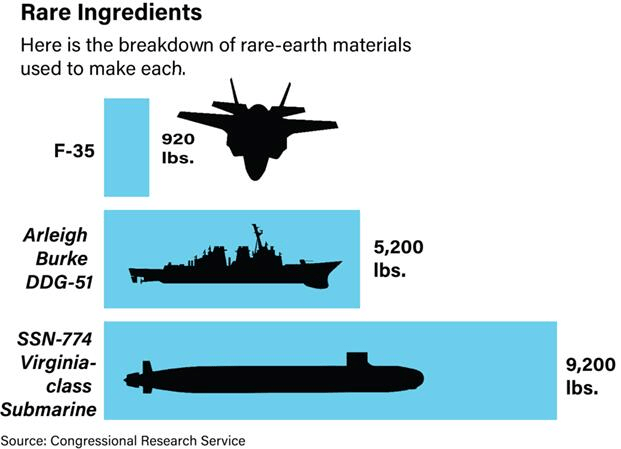

China could also tighten further restriction on rare earth export and separation technologies imposed on December 21, 2023. This has significant implications for US national, economic, and rare earth security. Rare earth elements—a group of 17 metals—are used in defense technologies, including missiles, lasers, vehicle-mounted systems such as tanks, and military communications.

Chinese customs data show there have been no shipments of wrought and unwrought germanium or gallium to the US this year through October, although it was the fourth and fifth-largest market for the minerals, respectively, a year earlier.

Similarly, China’s overall October shipments of antimony products plunged by 97% from September after Beijing’s move to limit its exports took effect.

China’s Restrictions on Antimony Could Cripple US

Skydio Faces Supply Chain Disruption