US Sanctions Have Failed

China AI & Semiconductors Rise: US Sanctions Have Failed

Semianalysis.com • September 12, 2023

As we approach the 1-year anniversary on the October 7th China sanctions, it is abundantly clear that the export controls are failing. The Biden Administration’s stated aim was to limit Chinese firms’ ability to manufacture the highest end chips including those in AI and other technologies that could be used for nefarious purposes by the Chinese Communist Party. See the US justification below.

The PRC is rapidly developing Exascale supercomputing capabilities and has announced its intent to become the world leader in AI by 2030.

These systems are being used by the PRC for its military modernization efforts to improve the speed and accuracy of its military decision making, planning, and logistics, as well as of its autonomous military systems, such as those used for cognitive electronic warfare, radar, signals intelligence, and jamming.

Furthermore, these advanced computing items and “supercomputers” are being used by the PRC to improve calculations in weapons design and testing including for WMD, such as nuclear weapons, hypersonics and other advanced missile systems, and to analyze battlefield effects.

In addition, advanced AI surveillance tools, enabled by efficient processing of huge amounts of data, are being used by the PRC without regard for basic human rights to monitor, track, and surveil citizens, among other purposes.

to limit the PRC’s ability to obtain advanced computing chips or further develop AI and “supercomputer” capabilities for uses that are contrary to U.S. national security and foreign policy interests.

However, the release of Huawei’s new flagship chip on SMIC’s N+2 (7nm) process, Chinese companies’ continued importation of billions of dollars of advanced semiconductor manufacturing equipment, and acquisition of hundreds of thousands of powerful NVIDIA H800 & A800 chips, it is abundantly clear that the Commerce Department’s standards were set at a level that will not ultimately inhibit China from breaking through the barriers set last fall.

In this report we’ll explore what the Huawei chip crystallizes about the trajectory of Chinese domestic semiconductor manufacturing and AI capabilities. We will be covering:

- Huawei’s chip and its competitiveness with foreign chips.

- The market share/ASP/revenue impact to Apple, Qualcomm, and MediaTek from Huawei’s insourcing of silicon.

- SMIC’s N+2 (7nm) process technology, current capacity, and expansions plans

- The lithography tools they use and why current restrictions are flimsy.

- The potential of a future SMIC 5nm process node.

- Domestic AI capabilities using externally produced chips from Nvidia

- AI chips using domestic manufacturing

- RF capabilities for drones and detecting F35’s

- And finally, if the US and its allies are uncomfortable with this overall trajectory, a package of potential western responses to China related to front end equipment, chemicals, advanced packaging, and IP licensing that would totally shut out the CCP.

Huawei Kirin 9000S

Let’s jump right in with the talk of the town, Huawei’s Kirin 9000S produced by SMIC. The chip uses a custom Armv9 core, and a custom GPU architecture designed by Huawei. The ability to design leading architecture in China is a big deal.

While the US has stopped AMD and Intel from various CPU deals with China in the past, it has not done been able to do so with Arm. Partially this is due to the joint venture Arm has in China, which is not under their direct control.

Another reason is that the Armv9 instruction set is from Arm Cambridge. Additionally, they utilize Arm’s licensed A510 cores. The A510 core is designed in Arm’s Sophia France R&D center + Cambridge.

The chip is technically incredible. The performance and power consumption profile in a variety of tests bring it on par with 1 to 2-year-old Qualcomm chips (S888 & S8G1). The RF side of the chip is amazing, using an integrated modem that is on par with Qualcomm’s current best.

This is not surprising given Huawei was a bit ahead of Qualcomm before they were banned from using TSMC. The most important point is that the RF Front End chips are also domestically produced, which was a capability many thought China lacked.

The most shocking finding is that when direct comparisons are done on identical IP, the Arm A510 for Huawei’s Kirin 9000S built on SMIC’s N+2 (7nm) and 2022 Qualcomm’s S8G1 built on Samsung’s 4LPX process.

The performance and power consumption of the Arm A510 cores are effectively on par with each other despite the process technology gap, indicating SMIC N+2 is better than most in the west realize. Part of the reason these chips are so close to each other is Samsung’s poor yield and SMIC’s good yield.

Put simply, Kirin 9000S is a better designed chip than the West realizes. It has solid power and performance. Even with the lackluster export controls, this is a leading edge chip that would be near the front of the pack in 2021, yet was done with no access to EUV, no access to cutting edge US IP, and intentionally hampered. We cannot overstate how scary this is.

MediaTek, Qualcomm, and Apple Impact

Quantifying the impact to Apple is quite easy. They gained between ~35 to ~45 million units of iPhone sales as a direct result from the Huawei’s ban in late 2019. This is easily over $20B of annual revenue for Apple that could evaporate if Huawei is able to regain its old footing. That is just smartphones, the impact to tablets, smartwatches, and laptops will be even larger for Apple.

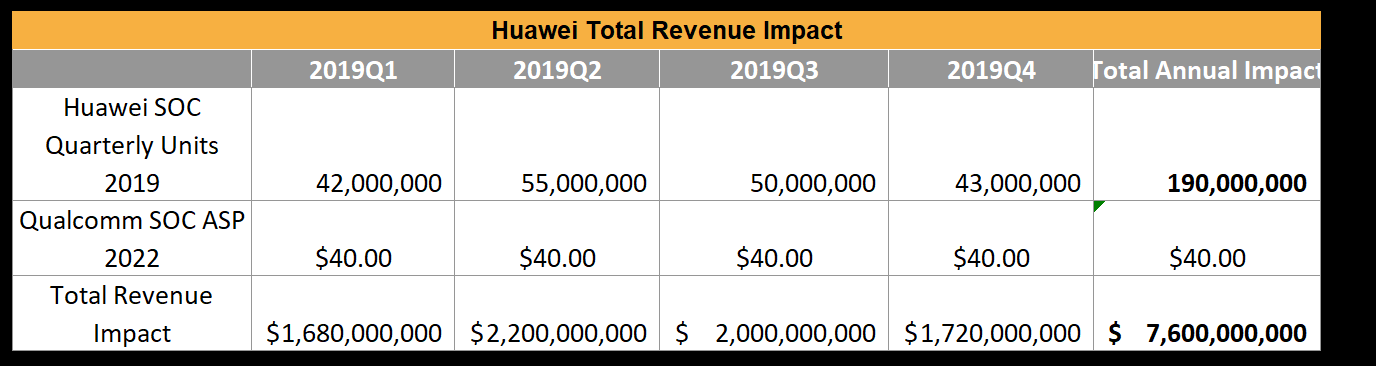

The impact for MediaTek and Qualcomm is even worse. Qualcomm and MediaTek were the main beneficiaries of the 190 million annual Huawei SoC units that evaporated from the market following their ban. From 2020 to now, this share shifted to other Chinese vendors such as Xiaomi, Oppo, and Vivo. If Huawei regains its form, we calculate as much as $7.6B of revenue impact to MediaTek and Qualcomm.

This of course was in a 1.4 billion unit smartphone market, the current run rate is under 1.2 billion units. A much more nuanced analysis of the above as well as the RFFE impact to Skyworks, Qorvo, Murata, Qualcomm, and others is available for our clients.

The ability of Huawei to regain form hinges primarily on SMIC’s manufacturing capabilities, which we believe are very strong.

SMIC N+2, A True 7nm, Good Yields

The process is a true 7nm process in terms of density. While the engineering decisions on specific pitches are different from TSMC’s 2018 7nm, it should be considered a similar process technology, and SMIC is at worst only a handful years behind TSMC.

One could argue that SMIC is at most only a few years behind Intel and Samsung despite restrictions. As SMIC is replicating what has been done elsewhere, the gap could be even narrower due to their excellent engineering pool from mainland China as well as many courted immigrants from Taiwan that were formerly employed by TSMC.

As mentioned earlier it is on par with Samsung’s 4LPX in performance and power. The big questions are yield and volume. While some pundits claim the yield is only 10%, we don’t believe that. In fact, we believe that SMIC’s process has good yield. There’s no definitive number here, but there are some data points that indicate this.

Why? We’ve heard a few soft remarks from our sources in China that yield is good. Allegedly their D0 is currently about ~0.14. For reference, TSMC’s N5 and N6 nodes are about half that. TSMC of course is the gold standard, and Samsung/Intel “7nm” are closer although still ahead of what SMIC has achieved.

For more, see