China Counterpunchs with Gallium and Germanium

China curbs a ‘potential bargaining chip’ to counter US-led semiconductor ban, say experts.

Totally Replacing Rare Metal Imports From China Could Take ‘Generations’

South China Morning Post • July 4, 2023 // Sputnik International • July 5, 2023

Beijing’s decision to impose export controls on critical raw materials, gallium and germanium, used in manufacturing semiconductors, communication equipment and solar panels could complicate the US-led efforts to shift critical supply chains away from China, experts said on Monday, as it seeks to gain leverage in negotiations with Washington over access to core technology.

“If China chooses to weaponise these supply chains, it will greatly complicate the calculus in the US, EU and Asia in terms of reducing dependence on China,” an effort that is just beginning, said Paul Triolo, a senior associate at the Center for Strategic and International Studies, a think tank in Washington.

He added that it would take “considerable time and investment to recreate even a portion of critical mineral supply chains,” stressing that Beijing “almost certainly sees these controls as a potential bargaining chip, which it could use to attempt to convince the US and Western governments to roll back elements of recent export controls on semiconductors and semiconductor manufacturing equipment.”

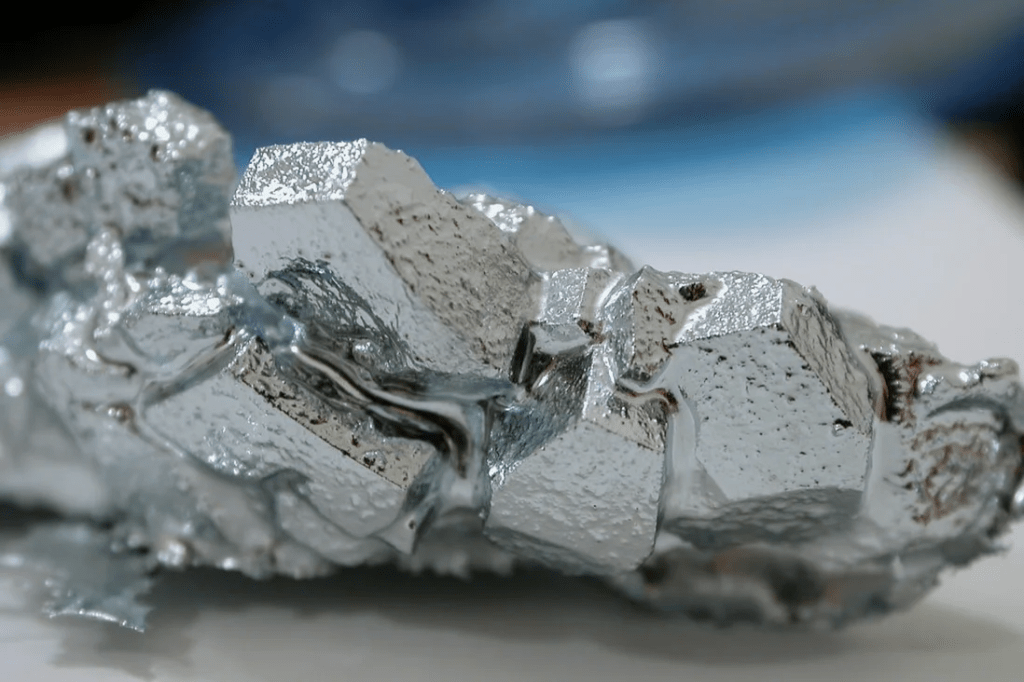

Starting on August 1, exports of gallium, germanium and several other industrial compounds will be subject to restrictions in order to “safeguard national security and interests,” China’s Ministry of Commerce and Administration of Customs announced on Monday. Exporters will be required to have approval from the State Council, China’s cabinet, for the listed items.

China is by far the world’s biggest gallium producer and a leading global producer and exporter of germanium— accounting for 94% of gallium supply and 83% of germanium, according to a European Union study on critical raw materials this year.

The measure is the latest development in the global battle to control chipmaking technology, which is vital for everything from smartphones and self-driving cars to advanced computing and weapons manufacturing.

Beijing’s move comes just days after the Dutch government announced new restrictions on exports of some semiconductor equipment, drawing an angry response from Beijing, according to Reuters. The new rules mean that ASML (ASML), Europe’s largest tech firm, will need to apply for export licenses for products used to make microchips.

Japan and the United States have also taken steps to limit Chinese companies’ access to chips and chipmaking equipment. Italy last month imposed several curbs on Pirelli’s biggest shareholder, Sinochem, to block the Chinese government’s access to sensitive chip technology.

The US Commerce and Treasury departments did not respond to requests for comment.

Calling the measure retaliation for the United States’ October 2022 ban on the export of some cutting-edge semiconductor technology to China, experts said that although Beijing’s curbs “will likely have an impact on a large number of countries,” Washington was “the main target.”

The US media noted at the time that Washington’s move would thwart “China’s technological ambitions,” bragging that the global semiconductor industry was “almost entirely” dependent on the US and its allies.

Now the American newspapers are admitting China has played “a trump card in the chip war.”

“I find it rather laughable that [the Biden administration] actually thought that they’re going to win this tech war,” Thomas W. Pauken II, the author of US vs China: From Trade War to Reciprocal Deal, and a consultant on Asia-Pacific affairs, told Sputnik.

“You don’t have access to the rare earth, you don’t have access to the supply chains in order to produce these electronics – you’re totally destroyed, you’re devastated, the US knew about this. They knew how much they were reliant on the rare earths. They knew how much they had to rely on China in order to reshore their factories. And instead of trying to find ways to cooperate, they just decided to go ahead and just do these no nasty, terrible attacks against China and then just somehow think they’re going to score a victory here.”

Why Didn’t Team Biden See This Coming?

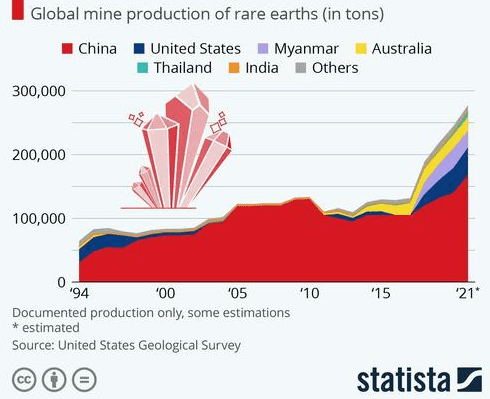

The People’s Republic boasts 63% of the world’s rare earth mining, 85% of processing, and 92% of magnet production. As per the 2022 US Geological Survey, between 2017 and 2020 the United States imported a whopping 78% of its rare earth metals from China, followed by Estonia (6%), Malaysia (5%) and Japan (4%).

Back in 2019, the Asian giant warned the Trump administration about including rare earths in Beijing’s technology-export restrictions, as Washington stepped up pressure on Chinese telecom firm Huawei.

Donald Trump’s successor, Joe Biden, continued to raise the stakes in a technological tit-for-tat with China by implementing the CHIPS and Science Act in August 2022 and introducing semiconductor restrictions last October. In December 2022, US policy-makers were lively discussing possible bans on TikTok, a Chinese short-form video hosting service.

Speaking to Sputnik at the time, Pauken projected that Biden’s China strategy would eventually backfire on Washington.

“If the US moves forward on decoupling, they’re only hurting themselves, because most of the supply chains on the high-tech side originate from China,” the Asia-Pacific consultant warned last December.

Given that 94% of the world’s gallium and 83% of germanium is produced in China, the US may find itself in a heap of trouble in the aftermath of Beijing’s export ban, according to the expert.

On Wednesday, former vice-minister of commerce Wei Jianguo spoke to state media China Daily and said Beijing has plenty of tools for countermeasures if the Biden administration continues to ramp up technology restrictions. He said the decision to restrict the export of gallium and germanium would “cause panic in certain countries, but also exert heavy pain in them.”

Wei said: “This is just the beginning of China’s countermeasures, and China’s toolbox has many more types of measures available. If the high-tech restrictions on China become tougher in the future, China’s countermeasures will also escalate.”

Totally Replacing Rare Metal Imports From China Could Take ‘Generations’